Choosing the right deductible is a crucial decision when selecting a car insurance policy, as it directly impacts both your out-of-pocket expenses in the event of a claim and your insurance premiums. A deductible is the amount you agree to pay towards repair costs or medical expenses before your insurance coverage kicks in to cover the remaining balance. Balancing cost and coverage when choosing the right deductible can help you find a policy that meets your financial needs and provides adequate protection without breaking the bank. Here’s how to make an informed decision:

-

Understand How Deductibles Work: Before choosing a deductible, it’s essential to understand how they work and the implications they have on your insurance policy. Typically, higher deductibles result in lower insurance premiums, while lower deductibles lead to higher premiums. Therefore, you need to decide how much you’re willing and able to pay out of pocket for repairs or medical expenses before your insurance coverage takes effect.

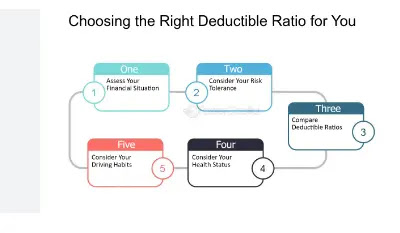

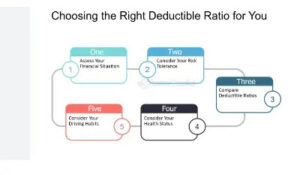

Assess Your Financial Situation: Consider your financial situation, savings, and ability to pay out-of-pocket expenses in the event of an accident or claim. If you have sufficient savings and can comfortably afford to pay a higher deductible without causing financial strain, opting for a higher deductible may be a viable option to lower your premiums and save money over time.

Evaluate Your Risk Tolerance: Evaluate your risk tolerance and comfort level with assuming more financial responsibility in exchange for lower premiums. If you’re a safe driver with a low likelihood of being involved in accidents or filing claims, choosing a higher deductible may be a suitable option to reduce your premiums and potentially save money on your car insurance.

Consider the Age and Value of Your Vehicle: The age and value of your vehicle can also influence your deductible decision. If you drive an older vehicle with a lower market value, opting for a higher deductible may make sense as the repair costs may be relatively low. On the other hand, if you drive a newer or more expensive vehicle, you may want to consider a lower deductible to minimize your out-of-pocket expenses in the event of an accident or damage.

Compare Deductibles and Premiums: When shopping for car insurance, compare deductibles and premiums from different insurers to find the best value for your money. Consider the total cost of the policy, including both the deductible and the annual premiums, to determine which option offers the most cost-effective coverage for your needs and budget.

Review and Adjust Your Deductible: As your financial situation and driving habits change over time, it’s important to regularly review and adjust your deductible to ensure it still aligns with your needs and circumstances. Reevaluate your deductible when renewing your policy or following significant life events such as purchasing a new vehicle, moving to a new location, or experiencing changes in your financial situation.

In conclusion, choosing the right deductible involves balancing cost and coverage to find a car insurance policy that meets your financial needs and provides adequate protection on the road. By understanding how deductibles work, assessing your financial situation and risk tolerance, considering the age and value of your vehicle, comparing deductibles and premiums from different insurers, and regularly reviewing and adjusting your deductible as needed, you can make an informed decision and select a car insurance policy that offers the best value for your money while ensuring you’re adequately protected against unforeseen accidents, damages, and liabilities.

Open next page to complete reading