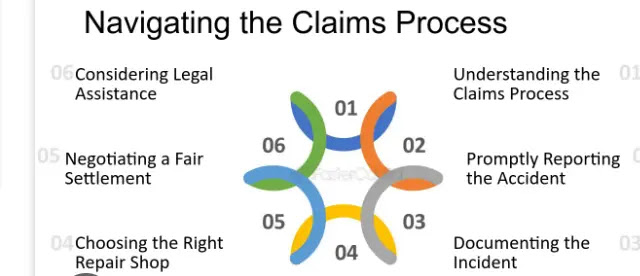

Navigating the claims process for premium car insurance can be a daunting task, especially during stressful and challenging times following an accident or unexpected event. However, understanding the steps involved and knowing what to expect can help make the process smoother and less overwhelming. Here’s a guide to navigating the claims process for premium car insurance:

-

Report the Incident Immediately: As soon as you’re involved in an accident or experience damage to your vehicle, contact your insurance company to report the incident and initiate the claims process. Most insurers have a 24/7 claims hotline or online portal where you can report the details of the incident and begin the claims process promptly.

-

Document the Incident: Gather as much information and evidence as possible at the scene of the incident, including photographs of the damage, contact information of any involved parties and witnesses, and a detailed description of what happened. This documentation will be crucial when filing your claim and can help expedite the claims process.

-

File a Claim: After reporting the incident to your insurance company and gathering all necessary documentation, you’ll need to formally file a claim. This typically involves completing a claims form provided by your insurer and submitting it along with any supporting documents, such as photographs, police reports, and witness statements.

-

Cooperate with the Claims Adjuster: Once your claim is filed, an insurance claims adjuster will be assigned to investigate the incident, assess the damages, and determine the extent of coverage under your policy. It’s important to cooperate fully with the claims adjuster, provide them with all requested information and documentation, and answer any questions they may have to facilitate a fair and timely claims resolution.

-

Review the Settlement Offer: After completing their investigation, the claims adjuster will present you with a settlement offer outlining the compensation for damages covered under your policy. Review the offer carefully to ensure it accurately reflects the extent of damages and coverage provided by your policy. If you have any concerns or believe the offer is insufficient, don’t hesitate to discuss them with the claims adjuster or your insurance company to negotiate a fair resolution.

-

Resolve the Claim: Once you’ve agreed on a settlement offer with the insurance company, you can proceed to resolve the claim and receive compensation for the damages to your vehicle or any injuries sustained in the incident. Depending on the nature and complexity of the claim, this may involve repairing your vehicle, replacing damaged parts, or receiving compensation for medical expenses, lost wages, and other covered costs.

-

Monitor Your Premiums: It’s important to be aware that filing a claim, especially for at-fault accidents or significant damages, can potentially impact your car insurance premiums. Insurance companies may consider your claims history and driving record when calculating your premiums upon policy renewal. Therefore, it’s advisable to weigh the benefits of filing a claim against the potential impact on your premiums and consider paying for minor damages out of pocket if the cost is relatively low compared to your deductible and potential rate increase.

In conclusion, navigating the claims process for premium car insurance requires patience, organization, and effective communication with your insurance company and claims adjuster. By understanding the steps involved, knowing your rights and responsibilities, and being proactive in documenting and reporting the incident, you

Open next page to complete reading