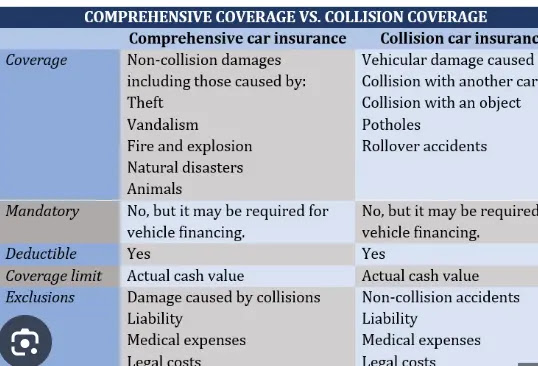

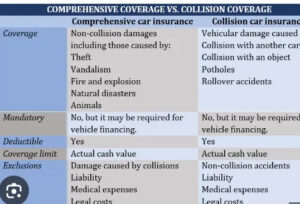

Comparing comprehensive and liability coverage options is crucial when selecting the right car insurance policy to suit your needs and budget. Comprehensive coverage provides protection against a wide range of damages to your vehicle that are not caused by a collision with another vehicle. This can include damages from natural disasters, theft, vandalism, and falling objects. While comprehensive coverage offers extensive protection, it typically comes with higher premiums due to the broader range of risks covered.

On the other hand, liability coverage is designed to cover damages and injuries you may cause to other parties in an accident where you are at fault. It includes both bodily injury liability, which covers medical expenses and lost wages for the injured parties, and property damage liability, which covers repair costs for damaged vehicles or other property. While liability coverage is generally more affordable than comprehensive coverage, it offers limited protection and may not cover damages to your vehicle or your own medical expenses in an accident where you are at fault.

Open next page to complete reading