In today’s fast-paced and ever-changing world, having the right car insurance coverage has become more crucial than ever before. As a responsible driver, you undoubtedly recognize the importance of safeguarding your vehicle and yourself against unforeseen accidents, damages, and liabilities.

Navigating the complex landscape of car insurance can often feel overwhelming and confusing, especially when faced with the myriad of premium rates, coverage options, and insurance providers available in the market.

Premium car insurance rates are not merely arbitrary numbers; they reflect the level of coverage you receive, the quality of service provided by the insurer, and the overall reputation of the insurance company. Therefore, choosing the right car insurance policy tailored to your specific needs and budget is essential to ensure comprehensive protection without breaking the bank.

1.Understanding the Factors That Influence Premium Rates

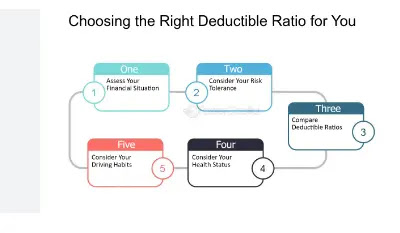

Understanding the factors that influence premium rates is essential for anyone looking to secure the best car insurance coverage tailored to their needs and budget. One of the primary determinants of your premium rate is your driving record. Drivers with a clean record and no history of accidents or traffic violations often receive lower rates as they are considered lower risks by insurance companies. On the other hand, drivers with a history of accidents, speeding tickets, or DUIs may face higher premiums due to the increased perceived risk associated with insuring them.

Additionally, the type of vehicle you drive can also significantly impact your premium rates. Insurers consider factors such as the make, model, and age of your car when calculating your premium. Generally, luxury cars, sports cars, and newer models with higher market values may result in higher insurance premiums due to the potential higher costs associated with repairs or replacements. Moreover, the location where you primarily drive and park your vehicle, your age, gender, and even your credit score can also influence your premium rates. By understanding these various factors, you can take proactive steps to mitigate risks, improve your driving habits, and potentially lower your car insurance premiums.