Selecting the best insurance provider for your needs is a critical decision that requires careful consideration and research. With so many options available in the market, finding the right insurance company that offers reliable coverage, competitive rates, excellent customer service, and flexible policy options can be overwhelming. To help you make an informed decision, here’s some expert advice on selecting the best insurance provider for your needs:

-

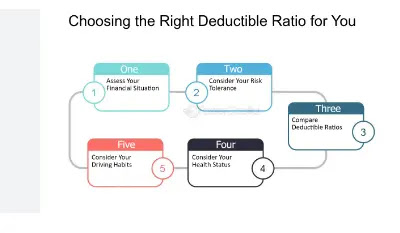

Assess Your Needs and Requirements: Before you start comparing insurance providers, take some time to assess your insurance needs, requirements, and budget. Determine the type and level of coverage you need, the deductible amount you’re comfortable with, and any specific features or add-ons you want to include in your policy. Understanding your needs and setting clear priorities will help you narrow down your options and focus on insurance providers that offer the most suitable policies for your situation.

-

Research and Compare Insurance Providers: Conduct thorough research and compare insurance providers based on their reputation, financial stability, customer reviews, coverage options, rates, discounts, and claim handling process. Look for insurance companies with a strong track record of reliability, positive customer feedback, and high customer satisfaction ratings to ensure you’re choosing a reputable and trustworthy provider.

-

Check Financial Stability and Ratings: It’s crucial to select an insurance provider that is financially stable and has a strong financial standing to ensure they can fulfill their obligations and pay claims when needed. Check the financial ratings and stability of insurance companies by reviewing ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, or Moody’s to gauge their financial health and stability.

-

Consider Customer Service and Support: Excellent customer service and support are essential factors to consider when selecting an insurance provider. Choose an insurance company that offers responsive customer support, helpful and knowledgeable representatives, and convenient communication channels to assist you promptly and efficiently with your inquiries, concerns, and claims.

-

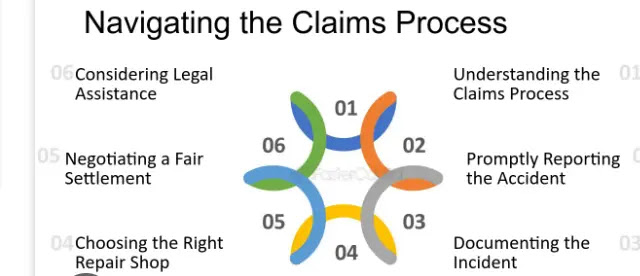

Evaluate Claims Process and Handling: The claims process and handling are critical aspects to consider when choosing an insurance provider. Look for insurance companies with a straightforward and efficient claims process, quick claims settlement times, and a reputation for fair and transparent claim handling to ensure a hassle-free and satisfactory experience when filing claims.

-

Review Policy Terms and Conditions: Carefully review and understand the terms, conditions, exclusions, limitations, and fine print of insurance policies offered by different providers. Pay attention to coverage details, policy features, add-ons, and any additional fees or charges to make sure you’re fully aware of what is covered, what is not covered, and any potential costs involved before making a decision.

-

Seek Recommendations and Referrals: Ask for recommendations and referrals from family, friends, colleagues, or trusted professionals who have experience with insurance providers and can share insights, advice, and recommendations based on their personal experiences and satisfaction with different companies.

In conclusion, selecting the best insurance provider for your needs involves thorough research, careful consideration, and a systematic approach to evaluating and comparing different options based on your insurance needs, budget, preferences, and priorities. By assessing your needs, researching and comparing insurance providers, checking financial stability and ratings, considering customer service and support, evaluating claims process and handling, reviewing policy terms and conditions, and seeking recommendations and referrals, you can make an informed decision and choose an insurance company that offers the best value for your money, reliable coverage, and exceptional service to meet your insurance needs and provide you with peace of mind on the road.

Open next page to complete reading